The search marketing landscape has shifted, with Google and Bing competing for market share following ChatGPT’s release by Microsoft-backed OpenAI. The chatbot’s immediate acclaim caused Bing search to experience a 40% overall user growth rate, compromising Google’s place as the leading search engine. In response, Google launched Bard, a conversational, generative AI chatbot that fell short of Microsoft, furthering the possibility of Bing dominating Google.

The search engine’s recent success allows brands to diversify their ad spend to reach various audiences. So how does Bing advertising differ from Google, and how can you optimize the search engine to expand your marketing efforts?

When evaluating advertising platforms, it’s crucial to note that Bing’s value outperforms Google’s in multiple areas, including ROAS. As Bing search gains recognition and popularity, keyword bidding has increased on the platform. Consequently, Bing advertising is more cost-effective, with a 70% CCP (cost-per-click) discount compared to Google’s 35% discounted rates. Additionally, although Google is the prime search engine on mobile devices, most desktop users run Windows applications where Bing is preinstalled, so brands with products that must be purchased on a desktop should pursue Microsoft advertising.

Marketing varies considerably between each search engine, with key considerations for SEO optimization. Bing and Google have exclusive methods for analyzing users and available websites in categories, including search drivers, performance, frequent keywords, experiences, and rankings. The primary distinction in assessments between these search engines is their emphasis on indexing and social signals. Google prioritizes search engine indexing to accumulate and store large amounts of data, producing accurate information to remain informed of comprehensive online activity. Conversely, Bing places significance on social signals by evaluating websites’ likes, shares, and visibility to rank meaningful content in various categories. Brands must focus on social performance to advertise on Bing effectively.

Generating social engagement through content creation is key for optimizing SEO on Bing. Some brands produce content for specific categories in select online communities, initiating adequate involvement within those groups and classifications. But Microsoft adjusts rankings based on social performance, favoring profiles with multiple tags, links, and shares, so it’s essential to create and launch content related to your brand or products. This may involve optimizing product detail pages (PDP) for specific search terms and generating content highlighting those PDPs. You can also develop influencer campaigns to grow your social presence.

However, brands sometimes struggle to grow their following organically, so you can assess campaigns and relationships to select ideal influencers based on value offerings.

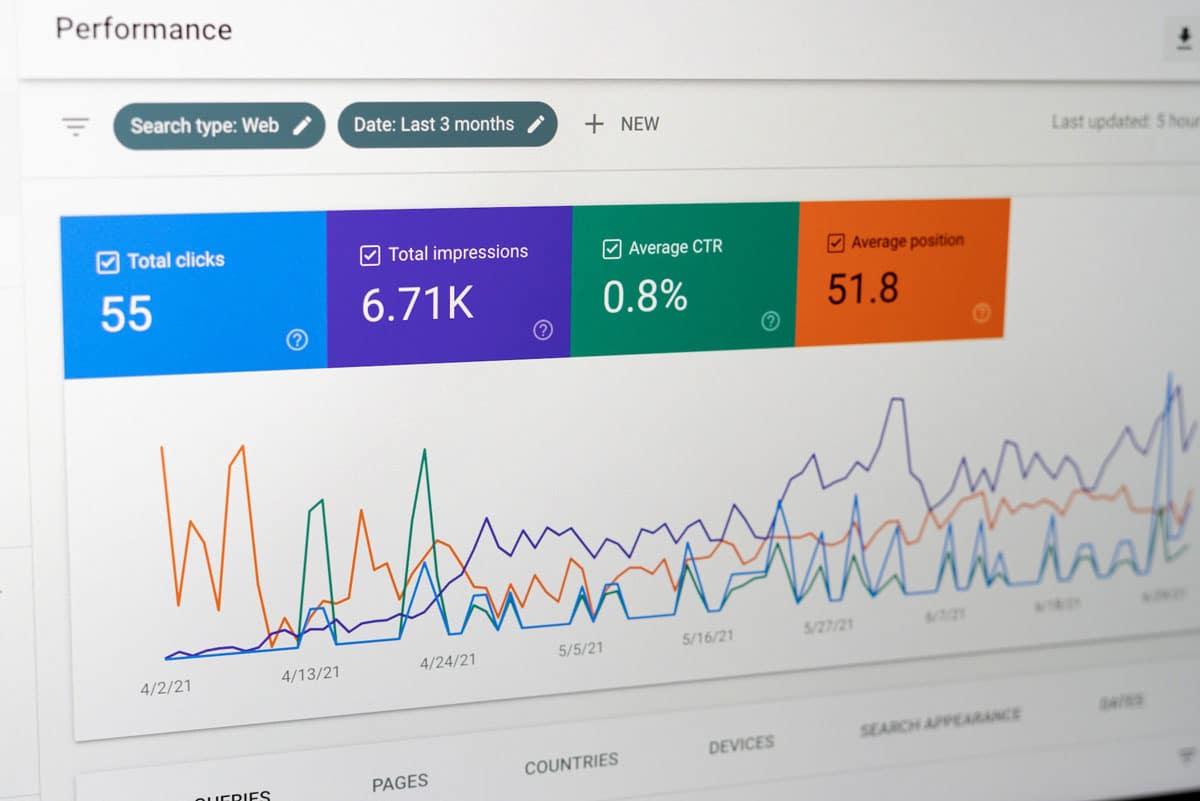

Bing can be used alongside Google ads to diversify your reach and revenue and experiment with Microsoft campaigns. Microsoft’s auto import function allows you to transfer data from Google ad campaigns to a Bing advertising account. Once you’ve launched campaigns on Bing, you should disable recurring imports to operate ads separately on each search engine, allowing you to gain distinct and precise insights and metrics.

President of Coalition Technologies, Jordan Brannon, lists best practices for launching and managing Bing campaigns following a transfer, “Make sure that your conversion counts match up to what you’re seeing in your store…Make sure that your landing page URLs made their way over correctly. Make sure you have the right landing page for the right ad group…Make sure you’re running the right targeting.”

Although Bing is not likely to surpass Google in the near future, Microsoft advertising can be a profitable long-term investment when considering its growth trajectory and influence on various users and businesses.

ChatGPT’s release has revolutionized AI, and industries have created innovative ways to deploy this tool and other models to enhance customer communication. Most recently, AI use cases have emerged in the banking, financial services, and investment (BFSI) industries that extend far beyond language processing capabilities.

How are financial institutions pioneering various AI tools for data generation, predictive analytics, and more?

NVIDIA conducted a survey demonstrating key opportunities for AI’s application in financial services. The survey revealed significant growth in use cases for natural language processing (NLP), large language models (LLM), and recommendation systems.

Practical applications for NLP and LLM exist within the context of contextual banking, where organizations have utilized tools like ChatGPT to gather insights on individual transactions and maximize the customer experience. Similarly, capital markets have leveraged these language models to predict stock market trends to manage assets and optimize investment portfolios. The final use case observed for this AI form involves fraud detection and identity verification related to banking and transactions.

Recommendation systems generate and analyze data to help consumers make informed financial decisions. These engines also assist organizations and internal stakeholders in recommending resources to their consumers. Spiralem’s Managing Partner, Bruno Diniz, cites an example of recommendation systems, stating that they can provide “financial information on a [case-by-case] basis that really reads information on the client, understands the problem they have, and makes an explanation specifically for a situation that perhaps the client has not even been able to assess themself.”

Many financial companies face challenges generating conversions, customer satisfaction, and retention. Recommendation systems and generative AI models provide opportunities for personalized content. Case in point, Capital One wanted to optimize conversions through a relevant homepage banner placement. Kevin Levitt, NVIDIA’s leader of Global Business Development for Financial Services, describes Capital One’s efforts: “They leveraged deep learning and NVIDIA’s application framework for recommendation systems…to understand and identify the optimal placement to give any consumer after they’ve logged in.” As a result, Capital One increased conversion rates by 60%.

Another company based in Brazil has deployed a generative AI tool to create customized content for asset management, business proposals, and hyper-personalization to meet individual needs and banking preferences. You can also use these models to develop optimized marketing and advertising copy.

Before piloting any AI model, it’s crucial to test its potential value for an organization by conducting proof of concept. Two sectors of BFSI have begun deploying testing for these models: compliance as a service (CaaS) providers and capital markets.

One CaaS organization has integrated ChatGPT to help banks comply with complex data-sharing regulations existing within federal and state privacy laws. Independent fintech advisor Efi Pylarinou explains how this company has executed PoC: “They are training and getting meaningful answers in terms of the risk that the financial services organization is running due to the complexity of these [regulations]. This highlights how important it is in terms of what prompts you’re asking these models and how you’re training them.” This business has successfully determined the value of ChatGPT in risk assessment and management.

Fintech companies are training LLMs to digitize documentation such as earnings reports, providing valuable insights into investment share prices for capital markets. Yet LLMs like ChatGPT supply general, nonspecific insights, so experimenting with multiple models is paramount.

Multiple institutions in various sectors have demonstrated the emerging potential for AI in BFSI and the value it can deliver to consumers.